Author's Note: We thank the digital wealth platform Endowus for co-contributing this article. Before investing, always seek financial advice from advisors like Endowus, who can assess your financial situation, advise your best course of action, and make an informed decision. Pick up more investing tips at Endowus Insights.

Endowus does NOT provide nor contribute to immigration or tax advice.

Every applicant is unique, and no one solution fits all. For personalized advice on PR application and immigration concerns, please reach out to The Immigration People.

Suppose you are a foreigner living and working in Singapore and have yet to hear about Supplementary Retirement Scheme (SRS). In that case, you may miss out on a valuable opportunity to grow your retirement savings while enjoying tax benefits.

The SRS is a voluntary savings scheme introduced by the Singapore government to encourage individuals to save for retirement. While it is commonly known and utilized by Singaporeans and Permanent Residents (PR), many foreigners are unaware of its existence and benefits.

Understanding and taking advantage of the SRS can provide a reliable and tax-efficient way to save for your future and fight long-term inflation.

This article aims to provide a comprehensive overview of the SRS, its eligibility criteria, benefits, and how you can maximize its advantages as a foreigner.

What Is The Supplementary Retirement Scheme?

The Supplementary Retirement Scheme is a voluntary personal income tax relief scheme introduced by the Singapore government to encourage tax-paying individuals to save for retirement. It offers various benefits, like reducing one's taxable income, making it an attractive option for foreigners living and working in Singapore.

Under this scheme, individuals can contribute up to a set amount each year. The money will be invested into various funds and instruments such as stocks, bonds, unit trusts, and real estate investment trusts.

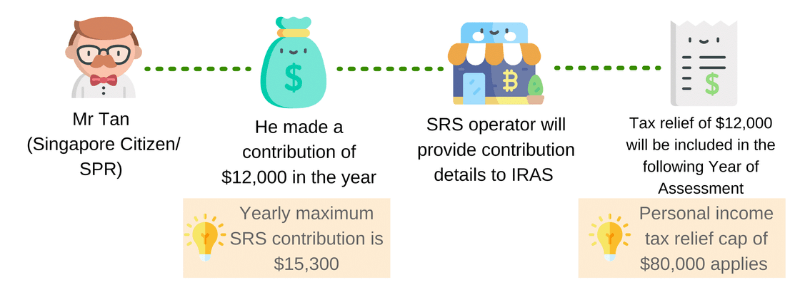

These investments will generate returns over time which can be used for retirement planning or other purposes. Contributions are eligible for tax relief up to a certain amount each year, with the maximum contribution cap set at S$15,300 for Singapore Permanent Residents and Singaporeans. Foreigners can contribute up to S$35,700 yearly.

Who Qualifies For SRS?

According to the Inland Revenue Authority of Singapore (IRAS), Singaporeans, PRs, and foreigners who derive any form of income can start their SRS contributions in the current year if they fulfil the following:

- Must at least be 18 years old;

- Not an undischarged bankrupt person;

- Not suffering from a mental disorder; and

- Capable of managing yourself and your affairs.

How Is Tax Calculated In Singapore?

As an expat living and working in Singapore, understanding the tax system is essential for financial success. One of the most important aspects is understanding how your taxes are calculated.

Expats in Singapore are treated as tax residents for the year of assessment if:

- They have lived or worked in Singapore for at least 183 days in the previous calendar year, or,

- They have continuously for three consecutive years, or,

- They have worked in Singapore for a continuous period straddling two calendar years and their total period of stay is at least 183 days.

In Singapore, taxes are calculated based on a progressive tax rate system - even for foreigners. Simply put, the more you earn, the higher your tax bracket.

Resident tax rates from YA 2017 to YA 2023

| Chargeable Income (S$) | Income Tax Rate (%) | Gross Tax Payable (S$) |

|---|---|---|

|

First $20,000 Next $10,000 |

0 2 |

0 200 |

|

First $30,000 Next $10,000 |

- 3.50 |

200 350 |

|

First $40,000 Next $40,000 |

- 7 |

550 2,800 |

|

First $80,000 Next $40,000 |

- 11.50 |

3,350 4,600 |

|

First $120,000 Next $40,000 |

- 15 |

7,950 6000 |

|

First $160,000 Next $40,000 |

- 18 |

13,950 7,200 |

|

First $200,000 Next $40,000 |

- 19 |

21,150 7,600 |

|

First $240,000 Next $40,000 |

- 19.50 |

28,750 7,800 |

|

First $280,000 Next $40,000 |

- 20 |

36,550 8,000 |

|

First $320,000 In excess of $320,000 |

- 22 |

44,550 |

Non-Resident Individuals are generally taxed at 15% of gross income or 22% of net income as long they are working professionals.

SRS Contributions for Foreigners

The tax benefit will appeal to those looking to lower their taxable income, as their income bracket determines it and affects their annual tax payment.

By investing in your SRS, you can potentially save a significant amount of money on your annual income tax. Use the Endowus SRS tax savings calculator to determine your potential savings.

Foreigners in Singapore can allocate up to S$35,700 into the SRS for a tax deduction on their existing tax liability.

| Yearly maximum SRS contributions | |

|---|---|

| Singapore Citizens / Singapore PRs | S$15,300 |

| Foreigners | S$35,700 |

If you fall within or exceed the 11.5% tax bracket, it may be worth considering investing in the contribution limit of $35,700 to your SRS account, as long as you don't have any immediate financial obligations.

One's financial situation and investment views can change over the years. Thus, always remember that you can adjust your SRS contribution amount accordingly.

In short, you should explore contributing to the SRS if:

- You are part of the middle to high-income bracket;

- It is unlikely that you will need to withdraw the funds early; and

- The money will be used for investing.

SRS Fund Withdrawals

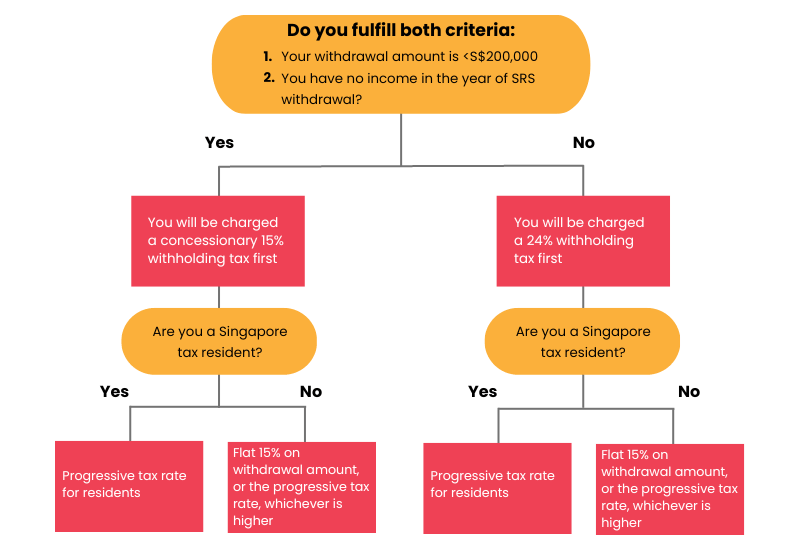

Withdrawing your SRS funds is a great way to leverage tax savings and implement your retirement plan.

Penalty-free withdrawals can be made from the statutory retirement age of 63 onwards or after ten years of SRS account funding for foreigners, and only 50% of the withdrawn amount will be subject to tax.

In short, when you withdraw $2, the government will tax only $1, allowing you to maximize this tax concession.

You may also choose to withdraw early - at a cost.

A 5% withdrawal penalty will be imposed on account holders who withdraw the money before the locked-in retirement age (63 years old) or ten years for a foreigner. You will also need to pay the full taxes on the sum withdrawn.

As a foreigner, you are entitled to a penalty-free withdrawal before your retirement age if you fulfil these two conditions:

- Withdrawing after ten years of yearly contributions, and

- Withdrawing in the full amount.

You may make a penalty-free early withdrawal on medical grounds.

SRS And Withholding Tax

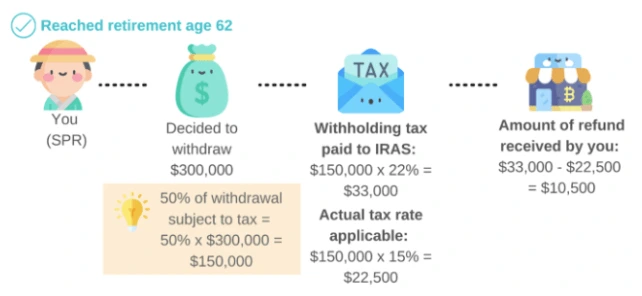

Withholding taxes are imposed on expats withdrawing their SRS sums. If someone not a Singapore citizen or PR takes out money or investments from their SRS account, they will be charged a withholding tax of either 50% or 100% of the amount withdrawn, depending on the type of withdrawal.

The SRS bank operator will withhold an amount of tax at the prevailing non-resident tax rate of 22% at the point of withdrawal. This sum will be remitted to IRAS.

Please note that the withholding tax is not the final amount of tax you owe. The tax withheld from your SRS withdrawal will be used as a credit to reduce your tax liability. It also means that if there is any remaining unused tax credit, it will be refunded back to you.

The Immigration People Advice: How SRS Can Improve Your Singapore Permanent Residency Chances

As competition for the Singapore PR status becomes tighter, it begs the question: how can you prove to the Immigration & Checkpoints Authority (ICA) that you are committed to being a part of Singapore?

Singapore is known for its strict and selective immigration policy, ensuring that only the most qualified individuals are granted PR status.

With a limited PR approval rate, it would take more than just checking off the basic eligibility.

The ICA holistically evaluates each profile on factors such as family ties, social contributions, economic and financial contributions, etc. Here is an excerpt of a speech given by Minister Indranee Rajah at the Committee of Supply Debate 2023:

We consider very carefully, who we take in as immigrants. When granting PR or citizenship, we look at a comprehensive set of factors, including an individual’s family ties to Singaporeans, economic contributions, qualifications, family profile, age and how long they have stayed in Singapore. This ensures that new immigrants are rooted, able to integrate and contribute meaningfully here.

Effectively demonstrating your financial capabilities and commitment to be a part of Singapore for the long term through efforts such as opening and contributing to your SRS account can potentially improve your PR application strength.

Aside from opening an SRS account and being consistent with yearly contributions, you can also integrate with Singaporean society through volunteering acts and providing testimonial letters from Singapore citizens.

Although these are actual strategies that The Immigration People personally advise clients, they should not be mistaken as guarantees for PR approval. It is always advisable to seek help from professional immigration consultants in Singapore.

To learn more about the Singapore PR application, schedule a free consultation with The Immigration People.

Where Can I Start My SRS Contribution?

To start, select an approved bank or institution that offers SRS services. You can choose to open an SRS account from the following banks:

- DBS

- OCBC

- UOB

Once you have decided, complete the application form and submit the relevant documents. As a foreigner in Singapore, expect also to complete a declaration form.

Once your application is approved, you can contribute to your SRS account.

After opening your SRS account, you may link your SRS account number to your Endowus account, if you have one. Click here to find out how to link your SRS account.

You will receive an email when your account is ready to invest using your SRS funds.

Conclusion

The SRS is a great way to save on taxes, diversify your investment portfolio and supercharge your retirement income. Foreigners should take advantage of this scheme as it offers a great tax-saving hack.

Although you can withdraw your SRS funds at any juncture, you will be slapped with a 5% penalty if you perform an early withdrawal. To ensure these funds remain in place and to serve their primary purpose in your retirement, you will also be taxed on whatever amount is withdrawn prematurely.

One must decide if setting aside significant money each financial year is viable without affecting your life plans. Tax relief can be tempting at first glance, but the greater temptation to withdraw funds prematurely, in the event of need or want, must be addressed.

If you would like additional information about SRS investment, you can reach out to Endowus. We also have a special benefit for those interested in signing up with Endowus here!

Endowus disclaimer (For content contributed by Endowus)

The information provided by Endowus Singapore Pte. Ltd. ("Endowus") is for information purposes only and should not be considered as an offer, solicitation or advice for the purchase or sale of any investment products. It is recommended that you seek financial advice as to the suitability of any investment. Whilst Endowus has tried to provide accurate and timely information, there may be inadvertent delays, omissions, technical or factual inaccuracies or typographical errors. Any opinion or estimate above is made on a general basis and none of Endowus, nor any of its affiliates, representatives or agents have given any consideration to nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Opinions expressed herein are subject to change without notice. Investment involves risk. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Past performance is not an indicator nor a guarantee of future performance. Please note that the above information does not purport to be all-inclusive or to contain all the information that you may need in order to make an informed decision. The information provided by Endowus herein is not intended, and should not be construed, as immigration, legal, tax, regulatory, accounting or financial advice. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Frequently Asked Questions About SRS For Foreigners

Who should invest in SRS?

SRS is an ideal saving investment option for foreigners, Singaporeans and PRs looking to secure their financial future. It offers an array of tax reliefs and incentivizes long-term savings through its potential returns.

The SRS provides a reliable and tax-efficient way to save for retirement, with contributions being eligible for tax relief up to a certain amount each year. SRS monies earn just 0.05% interest per annum (p.a.), if invested correctly can also an effective way to fight inflation and ensure that your money has the potential to grow over time.

Can I invest my SRS money?

Yes, you can invest your SRS money.

The money you contribute to the SRS is meant to be kept in a savings account and invested into various instruments such as stocks, bonds and mutual funds. This investment strategy allows for potential capital appreciation over time, allowing you to maximize the returns on your investments.

Investing your SRS money also offers tax benefits, which could result in significant long-term savings.

Past performance does not predict or ensure future performance. Do note that investment returns are not guaranteed and are subject to market risks.

How to open an SRS account for foreigners?

Opening an SRS account is a simple process for foreigners in Singapore. Here are the steps to follow:

- Select an approved bank or institution offering SRS services that suit your needs.

- Complete the application form and submit all relevant documents, such as identification proof, passport-size photographs, and proof of address in Singapore. You may also be required to submit a cover letter explaining why you are eligible for SRS.

- Once your application is approved, you can contribute to your SRS account.

- Monitor the performance of your investments and make changes as necessary.

Even SRS investments would be subject to investment risk. Thus, you should always consult a financial advisor before making investment decisions.

Does SRS make sense for foreigners?

The SRS is a great way for foreigners to save on taxes and build your nest egg.

While it does come with certain risks, such as market volatility, it also offers numerous potential benefits, such as tax incentives and long-term savings growth.

Furthermore, investing your money in approved instruments can maximize your returns and ensure you get the most out of your income.